Accounting & Bookkeeping for Small Businesses

CPD & IAP Accredited | Free E - Certificate Included | Unlimited Lifetime Access | No Hidden Fees

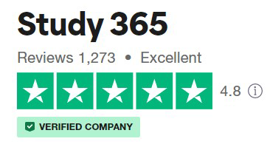

Study365

Summary

- Exam(s) / assessment(s) is included in price

Add to basket or enquire

Overview

Diploma in Accounting & Bookkeeping for Small Businesses (USA Standards)

Do you own or manage a small business? Perhaps you’re looking for a career change? Maybe you just want to gain certification of your skills?

Whatever your situation is, learning how to properly carry out accounting and bookkeeping for a small business is extremely useful, and isn’t as difficult as you might think. We make accounting enjoyable and have broken this diploma into modules which are easy to understand, so you can build your knowledge as you go.

Small business accounting involves basics of the accounting cycle plus inventory control, if needed. This diploma covers 11 helpful modules, a module book, a bookkeeping training manual and additional study materials, all of which will give you a full understanding of accounting and bookkeeping for small businesses (USA Standards). Create a reliable and effective accounting and bookkeeping system for your business, or make the career change you’ve always hoped for.

Learning with Study 365 has many advantages. The course material is delivered straight to you and can be adapted to fit in with your lifestyle. It is created by experts within the industry, meaning you are receiving accurate information, which is up-to-date and easy to understand.

This course is comprised of professionally narrated e-Learning modules, interactive quizzes, tests, and exams. All delivered through a system that you will have lifetime access for 24 hours a day, 7 days a week. An effective support service and study materials will build your confidence to secure your qualification.

Please Note: This Course is Based on USA Standards

* Free E-certificate (No additional cost for E-certificates)

Why You Should Choose Study 365

- Lifetime access to your course.

- The price shown on Reed is for the whole course, including the final exam and free e-certificate.

- CPD and IAP accredited certificate upon successful completion

CPD

Course media

Description

This online training course is comprehensive and designed to cover the following key topics are listed under the curriculum. This course has been designed for 30 guided learning hours.

COURSE CURRICULUM

Module 01 : Introduction to Accounting

- What is Accounting and Why Does It Exist?

- Four Flavours of Accounting

- The Three Primary Financial Statements

- Walmart

- Managerial Accounting

- More about Income Taxes

Module 02 : Financial Statements

- Balance Sheet

- Income Statement

- Cash Flows

Module 03 : Assets and Liabilities

- Chart of Account

- Add New Account

- Write Checks

- Make General Journal Entries

- Prepaid Rent

Module 04 : Accounting Transactions

- Trial Balance

- Adjusting Entries

- Closing the Books

- Sales Revenues, Gross Profits and Operating Activities

Module 05 : Inventory and Cost Methods

- Classifying Inventory

- Determining Inventory Quantities

- Costs of Goods Sold

- FIFO and LIFO

- Average Cost Method

Module 06 : Stakeholders and Equity

- Corporate Form of Organization

- Stock Issue Considerations

- Accounting for Treasury Stock

- Preferred Stock

- Dividends and Retained Earnings

Module 07 : Managerial Accounting

- Introduction to Managerial Accounting

- Code of Ethics for Managerial Accounting

- Managerial Cost Concepts

- Other Managerial Concepts

Module 08 : Cost Accounting

- Cost Accounting Systems

- Job Order Cost Flow

- Reporting Job Order Costing

- Process Cost Systems

- Activity Based Costing

Module 09 : Costs and Expenses

- Cost Behaviour

- Break Event Analysis and Contribution Margin Ratio

- Margin of Safety

Module 10 : Budgetary Control

- Budgetary Control

- Static and Flexible Budgets

- Responsibility Accounting

- Standard Costs

- Analysing and Reporting Variances

Module 11 : Analysis and Decision Making

- Introduction to Management Decision Making

- Incremental Analysis

- Capital Budgeting

- Other Tools for Analysis and Decision Making

Course Duration:

You will have lifetime access to your online study platform from the date you purchased the course. The course is self-paced so you decide how fast or slow the training goes. You can complete the course in stages revisiting the training at any time.

Method of Assessment:

At the end of the course learners will also take an online multiple choice questions assessment test. This online multiple choice questions test is marked automatically so you will receive an instant grade and know whether you have passed the course.

Certification:

Successful candidates will be awarded certificate for “Diploma in Accounting & Bookkeeping for Small Businesses”.

Why Choose Us?

- Our courses represent outstanding value for money

- High quality e-learning study materials and mock exams.

- Each course is designed by industry experts, using an innovative interactive learning approach.

- Includes step-by-step guided videos tutorials.

- 24/7 Access to the Online Learning Portal.

- Anytime & Anywhere Learning.

- Recognised Accredited Qualification.

- Access Course Content on Mobile, Tablet or Desktop.

- Study in a user friendly, advanced online learning platform.

- Excellent customer service and administrative support.

Who is this course for?

- This Small Business Accounting course will be of great interest to business owners and business professionals who would like to better understand the transactions and controls used in business, and to any learner who is interested in accounting as a future career.

Requirements

This course requires no formal prerequisites and this certification is open to everyone

Career path

There are several roles in Accounting and many different ways you can climb the ladder to make your way to the top. It is important to understand what your various Accounting career options and few of them are listed in below:

- Finance Controller

- Payroll Administrator

- Account Clark

- Bookkeeper

- Bookkeeping Assistant

- Account Assistant

- Office Administrator

- Office Manager

- Payroll Clerk

- Staff Accountant

Questions and answers

Can I view the certificate to be awarded after successful completion of the Diploma course, please?

Answer:Dear Yao, Thank you for your query. Yes you can, Successful candidates will be awarded certificate for “Diploma in Accounting & Bookkeeping for Small Businesses”. Regards, Student Support Team

This was helpful.Would a hard copy of the certificate be available please

Answer:Yes, If you require a Hardcopy version of the certificate you can request it with the certification payment.

This was helpful.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.